The week ending May 6th, 2024, was a turbulent market heavily influenced by hedging flows. The evidence was clear in pronounced variations in implied volatility gauges, such as the VIX and the XVIX, which makes it hard to understand the genuine market attitude.

The market’s performance on Friday was tricky to grasp. A gain of 1% in the market was widely anticipated due to the implied short-term volatility rates. However, the absence of any trend towards higher rates and the weakening of the dollar defied expectations.

The Contrarian Market Response

Upon closer examination, a few intriguing patterns emerged. We noticed a break-up of that bullish-looking flag within the DXY and a rise in its 50-day moving average. This was in line with the actions of USDCAD and the USDCAD and USDJPY, which also found support at the 50-day and 60-day averages following initial decreases. Given the recent Bank of Japan intervention, the USDJPY’s intervention by the ence is Japan.

The two-year Treasury yield also showed an intriguing pattern. The 50-day moving mean has acted as a level of support during earlier uptrends of the 2-year yield often leading it to new heights. While past performance isn’t necessarily a reliable indicator of future results, this past precedent is worth a look.

Key Resistance Levels of Resistance for the Major Indices

Incredibly, all three major indices- the NASDAQ 100, S&P 500 and Dow Jones – encountered resistance at their 50-day moving averages Friday. This confluence of events suggests that positioning might significantly influence market movements. Algorithmic trading strategies depend on moving averages. It is possible to anticipate more than a more aggressive Fed policy, and a robust job report might be a reason for the apparent resistance.

The Fed and the Pivot on Rate Cuts

The meeting at the Federal Open Market Committee (FOMC) meeting was not the cause of any major shock. Powell’s remarks aligned with market expectations, and confident analysts believe that Powell might have chosen to adopt an aggressive tone. It is essential to know Powell’s present strategy. With the regular announcements from Fed members, Powell himself may not require the same amount of involvement in directing the direction of markets. Powell could delegate his communications to other policymakers and allow economic data to be the most important in the spotlight.

The main takeaway from the FOMC meeting is the recognition that the Fed is slowing its deflation process, which suggests a delay in rate cuts. Observing what announcements from Fed attendees this week will impact the market sentiment regarding rate reductions will be interesting. We are expecting various views on the subject, with some members advocating for lower cuts, even none, and possiblypossibly leading to the upward revision to the “dots” in the projected rates for the June meeting.

Nuances in Job Data and Market Effects

The most recent employment report has been a source of controversy. Some believe the Easter holiday was observed in March, which caused the pull-back of seasonal employment, resulting in a rise in March numbers and decreasing the numbers for April. When viewed through the lens of a two-month variation in non-farm payrolls, this data suggests a plateau but not a rise. The annualized growth of 6 months in pay has been relatively stable since December. This argument favours the notion that Easter could have influenced the figures.

Apple (AAPL) and Nvidia (NVDA) are in Focus.

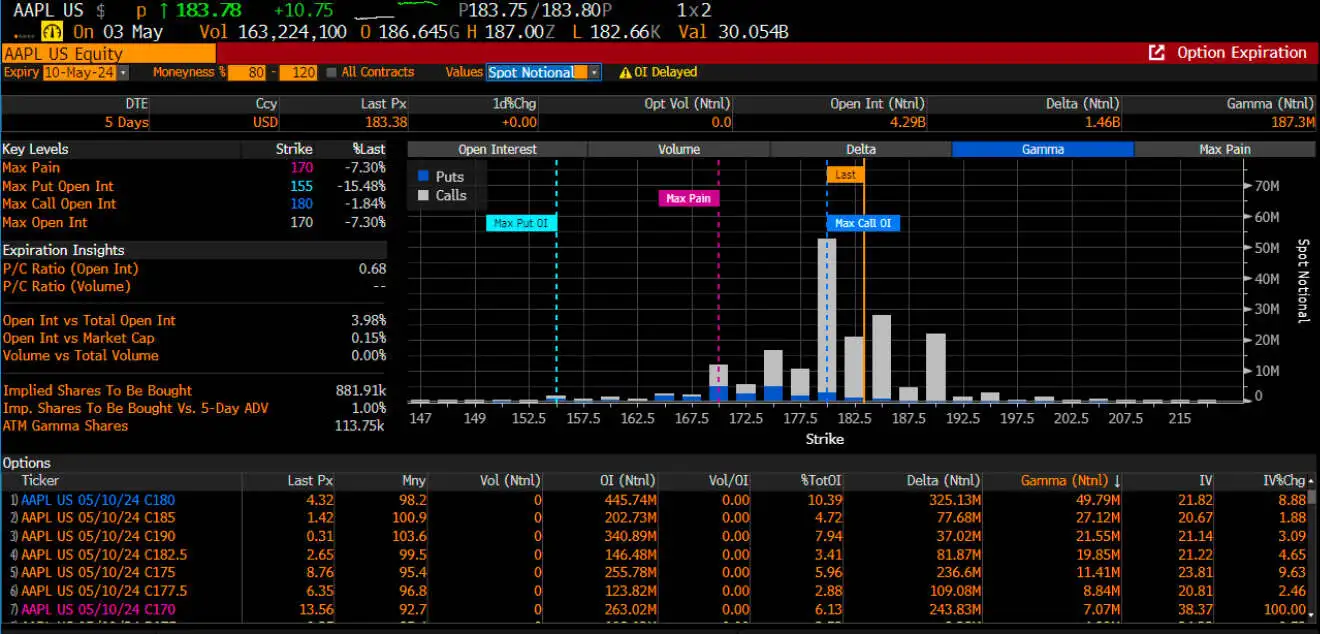

The ability of Apple to maintain the gains that it made on Friday was an unexpected delight. While the stock declined from its peaks, an endeavour to test the $180 price level is being considered. The price was in a significant range as we approached Friday, and it appears to be causing resistance another time in the past week. Because $185 is a “call Wall”, Apple could face issues soon.

Nvidia is confronting a significant hurdle at $900. If it can break through the $900 mark, it might lead to a $950 price compatible with the gamma position. However, the substantial rise in gamma within the $900-950 range indicates an upward trend towards $950 for Nvidia in this period. This suggests that $900 might attract many more purchasers than vendors.

The Final Word The Week in Tentative Equilibrium

The week ending May 6th was a glimmer of a market looking for direction. Although the Fed’s position regarding rate cuts received a lot of interest, the absence of a specific signal was a cause for investors to be in a wait-and-see mode. Major indices are finding resistance near their 50-day moving mean, and coming announcements by Fed members are things to watch over the next few days.