Introduction: Reputation Is Your Greatest Asset

In today’s business world, trust is currency and reputation is everything. One misstep, such as engaging with a politically exposed person (PEP) without proper due diligence, can cause long-lasting damage to a company’s image, stakeholder confidence, and even its bottom line.

As regulatory bodies raise expectations, and the public demands transparency, businesses must go beyond standard KYC. Incorporating robust PEP screening solutions is now essential for companies that want to protect their reputation and ensure ethical business conduct.

In this article, we’ll explore how effective PEP screening impacts corporate reputation and why it’s a key component of any modern compliance strategy.

What Is PEP Screening and Why It Matters

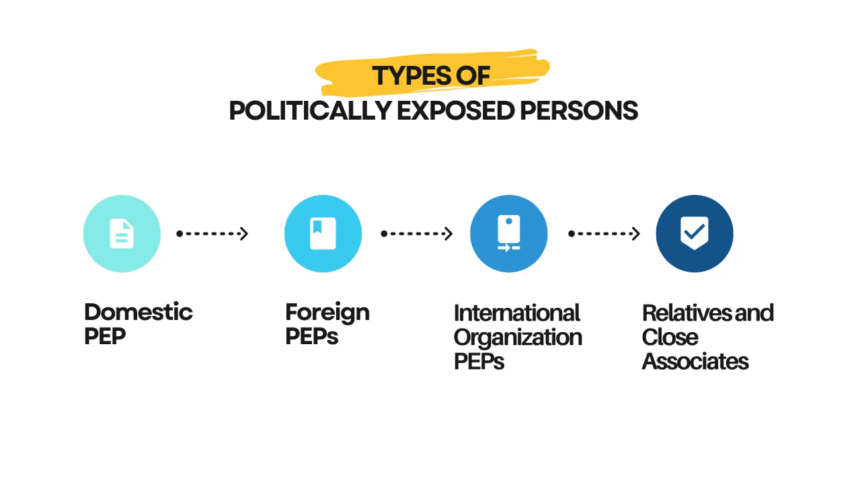

A politically exposed person (PEP) is someone who holds a prominent public position or has been entrusted with a high-level political function. Examples include:

- Heads of state and ministers

- Members of parliament

- Senior government or military officials

- Executives of state-owned enterprises

- Close family members and associates of PEPs

Due to their influence and access to public resources, PEPs pose a higher risk of involvement in bribery, corruption, and money laundering.

PEP screening involves identifying and monitoring these individuals before entering into business relationships with them. This process is critical for:

- Meeting anti-money laundering (AML) and counter-terrorism financing (CTF) regulations

- Mitigating reputational risk

- Demonstrating ethical due diligence to stakeholders

The Link Between PEP Screening and Corporate Reputation

1. Risk of Reputational Fallout

Doing business with a high-risk individual — knowingly or not — can have serious consequences. Media exposure linking your company to corrupt officials can:

- Damage brand image

- Lead to public backlash or boycotts

- Trigger internal investigations

- Cause investors or partners to lose confidence

PEP screening solutions help detect these risks early, allowing businesses to avoid partnerships that could jeopardize their integrity.

2. Public Perception and Trust

Customers, partners, and shareholders care about who you associate with. Demonstrating that you’ve conducted due diligence, especially when working internationally, helps build trust and transparency.

By integrating PEP screening into your risk management workflow, you reinforce your brand as ethical and compliant a reputation that increasingly drives business success.

How PEP Screening Supports Regulatory Compliance

Regulatory frameworks around the world now require businesses to identify and manage risks associated with PEPs. Key standards include:

- FATF Recommendations (global AML/CTF standards)

- EU’s AML Directives

- USA PATRIOT Act

- FCA (UK) and FINTRAC (Canada) guidelines

Failure to comply can lead to:

- Heavy fines

- Sanctions

- Legal action

- Regulatory bans

By using automated PEP screening solutions, businesses ensure continuous compliance with both local and international regulations.

Modern PEP Screening Solutions: What They Offer

Effective PEP screening tools offer more than just basic list checking. Today’s leading platforms provide:

Global, real-time data on PEPs and their relatives or associates

Fuzzy name matching to catch spelling variations and aliases

Adverse media integration for early risk signals

Sanctions list monitoring across multiple jurisdictions

Ongoing monitoring and automatic alerts

Audit-ready reports for compliance documentation

These solutions reduce manual errors, cut down false positives, and provide a scalable way to manage risk without slowing down your onboarding or transaction processes.

Use Case: PEP Screening Protects a Global Logistics Firm

A UAE-based logistics company began onboarding new vendors in emerging markets. Using manual checks, they missed a PEP connection with a key supplier’s CFO, who was under investigation for embezzlement.

After implementing a real-time PEP screening solution, the company:

- Flagged the risk instantly

- Avoided reputational damage from future press coverage

- Documented the incident and response for regulators

- Enhanced internal controls and board confidence

The lesson: even non-financial companies benefit significantly from proper PEP screening.

Best Practices for PEP Screening and Reputation Management

- Screen everyone — not just customers, but also vendors, suppliers, and partners

- Automate where possible — manual checks are slow and error-prone

- Integrate into onboarding — embed PEP checks into CRM or KYC flows

- Use layered screening — combine PEP data with adverse media and sanctions checks

- Train your compliance team — ensure staff can interpret screening results appropriately

- Re-screen periodically — PEP statuses change; stay updated

Conclusion: Trust Begins with Transparency

In an era of increased scrutiny, PEP screening solutions are more than just compliance tools they’re essential safeguards for your company’s reputation and credibility.

Whether you’re onboarding clients, choosing vendors, or expanding internationally, having the right screening processes in place ensures that your business decisions reflect both due diligence and ethical leadership.

FAQs

Q: Do all PEPs pose a risk?

A: Not necessarily. The risk level depends on the person’s role, jurisdiction, and the nature of the business. However, all PEPs require enhanced due diligence.

Q: Can a company be held liable for failing to screen a PEP?

A: Yes. Regulators can impose fines and sanctions for lack of due diligence, even if the company was unaware of the PEP connection.

Q: Is PEP screening only for financial institutions?

A: No. It’s increasingly relevant for law firms, real estate agents, crypto platforms, logistics firms, and any company with global exposure.